What Drives Automation and Integration Adoption?

In our over 12+ years in the integration and automation industry, we have heard a lot of reasons why businesses of all sizes rely on these two solutions.

Back in 2009, when we first got started, automation would still make you think of clunky robots. And if it didn’t, then you were working for a Fortune 500 company that afforded to invest in developing proprietary automation or integration systems — or, more seldomly, buy them from vendors at prices that made your head spin.

In the last decade, things have changed massively. Almost every company relies on at least a few integration and automation solutions. But the market still has plenty of room to grow, as adoption in some industries is lagging behind.

So we wanted to put some numbers to the reasons we already knew and learn what exactly drives automation and integration.

Survey Methodology

We surveyed a wide range of professionals across the world, working with companies and organizations of all sizes. Our focus here was surveying the people who handle automation and integration in their company, so we can get a better feel of their needs and challenges.

Integration Maturity Level Across Surveyed Organizations

70.2%

of our respondents have been using integration for one to three years or for more than three years.

70.2%

of our respondents have been using integration for one to three years or for more than three years.

16.2%

of our respondents have been using integration for less than 3 months.

16.2%

of our respondents have been using integration for less than 3 months.

13.6%

of our respondents have been using integration for less than 6 months.

13.6%

of our respondents have been using integration for less than 6 months.

When coupled with our in-house data regarding the new subscribers that created an account with SyncApps starting with 2020 (when the first wave of the pandemic hit), we can confidently say that the integration adoption is still in its infancy for SMBs.

What Are the Main Drivers of Automation and Integration?

What drives companies to adopt integration and automation solutions? To answer that, we started by asking them how many software applications they use (to gauge the need for integration) and why they adopt “regular” software solutions — to gauge the difference between them and integration/automation if any.

70.2%

use between three and 10 software applications.

70.2%

use between three and 10 software applications.

This means a lot of data siloes and a lot of data that cannot be properly leveraged since it’s being kept away from other data it could be merged with.

Most of our survey respondents spend between one and five hours every week moving data between applications.

How Are SMBs Using Integration and Why?

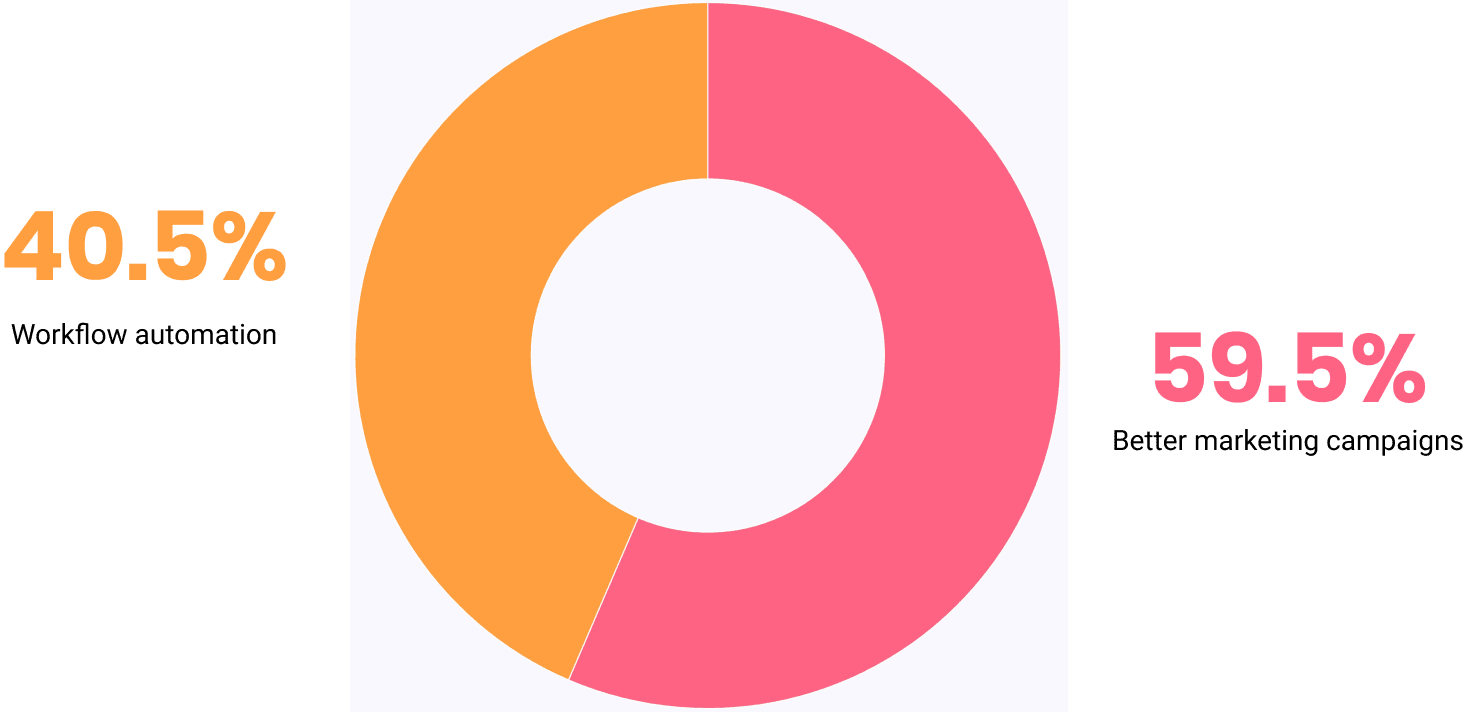

Our survey revealed that the main use case of integration is better marketing campaigns (59.5%), followed by workflow automation (40.5%).

Again, this is consistent with our day-to-day talks with the SyncApps subscribers. Integration fuels better marketing campaigns by combining insights from across platforms into a single dashboard, with relevant metrics viewable at a glance.

What Does the Future Hold in Store for Automation and Integration and the SMBs Relying on Them?

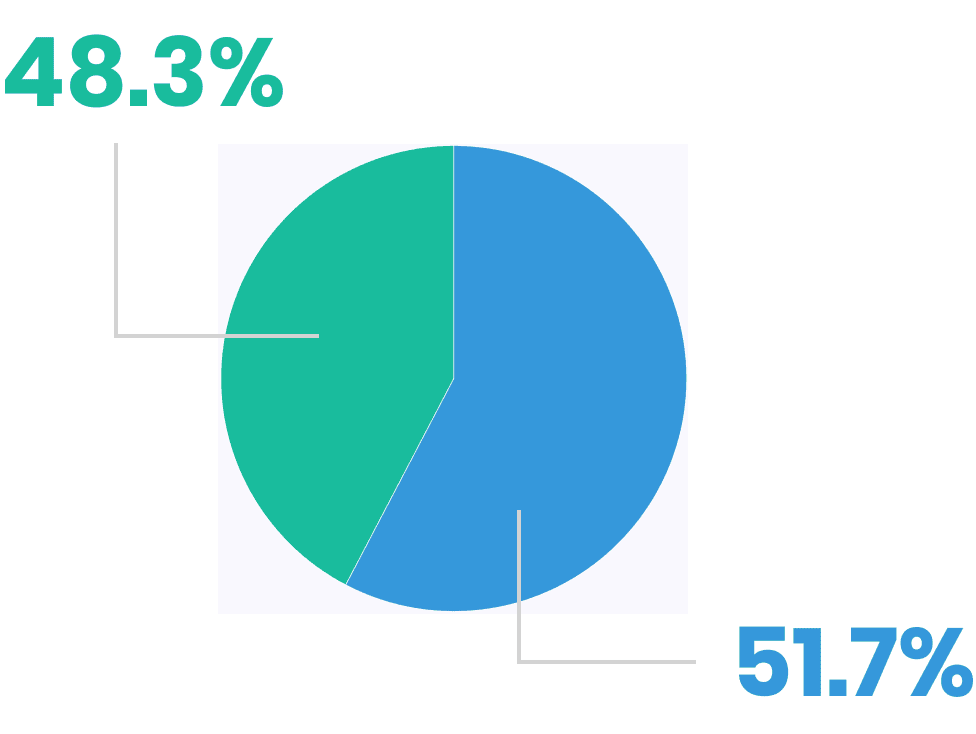

When asked about their plans for 2022, our respondents had an interesting take: a staggering 51.7% of them say they will maintain their software stack. At the same time, 48.3% of them plan to invest more in automation.