Everyone will remember 2020. The year that crashed into our lives (like Kramer from Seinfeld, if Kramer were a global macro shock) changed shopping habits in a weekend.

Years later, the headline is simpler but more demanding: digital commerce is bigger, noisier, more mobile, and less forgiving. The winners don’t just “do marketing.”

They automate, integrate, and observe — so the data flows, margins hold, and the team gets to sleep in December.

If you’re still running an eCommerce business, congratulations! You’ve survived the sugar rush of 2020–2021, the inflation hangover, and the “is social commerce real?” debate. Spoiler: it is.

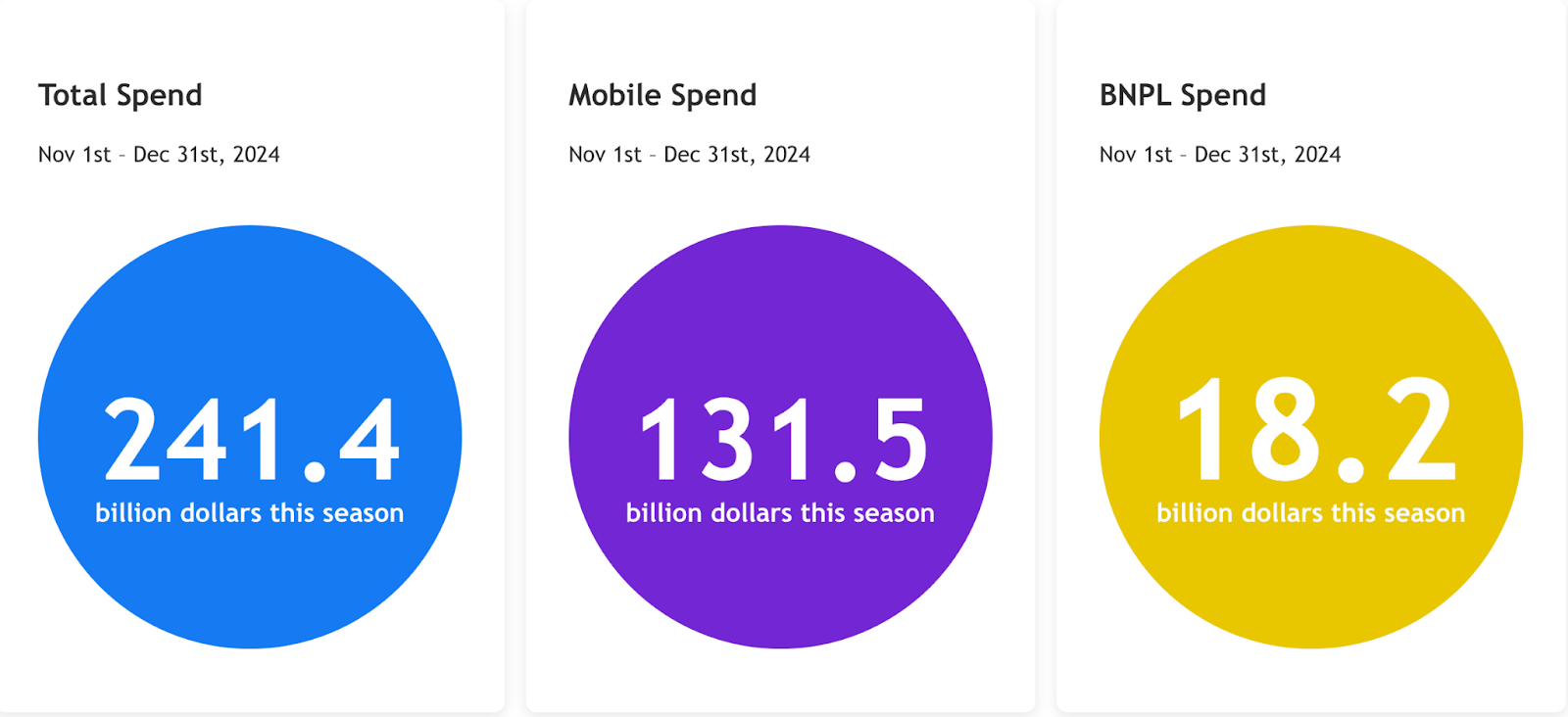

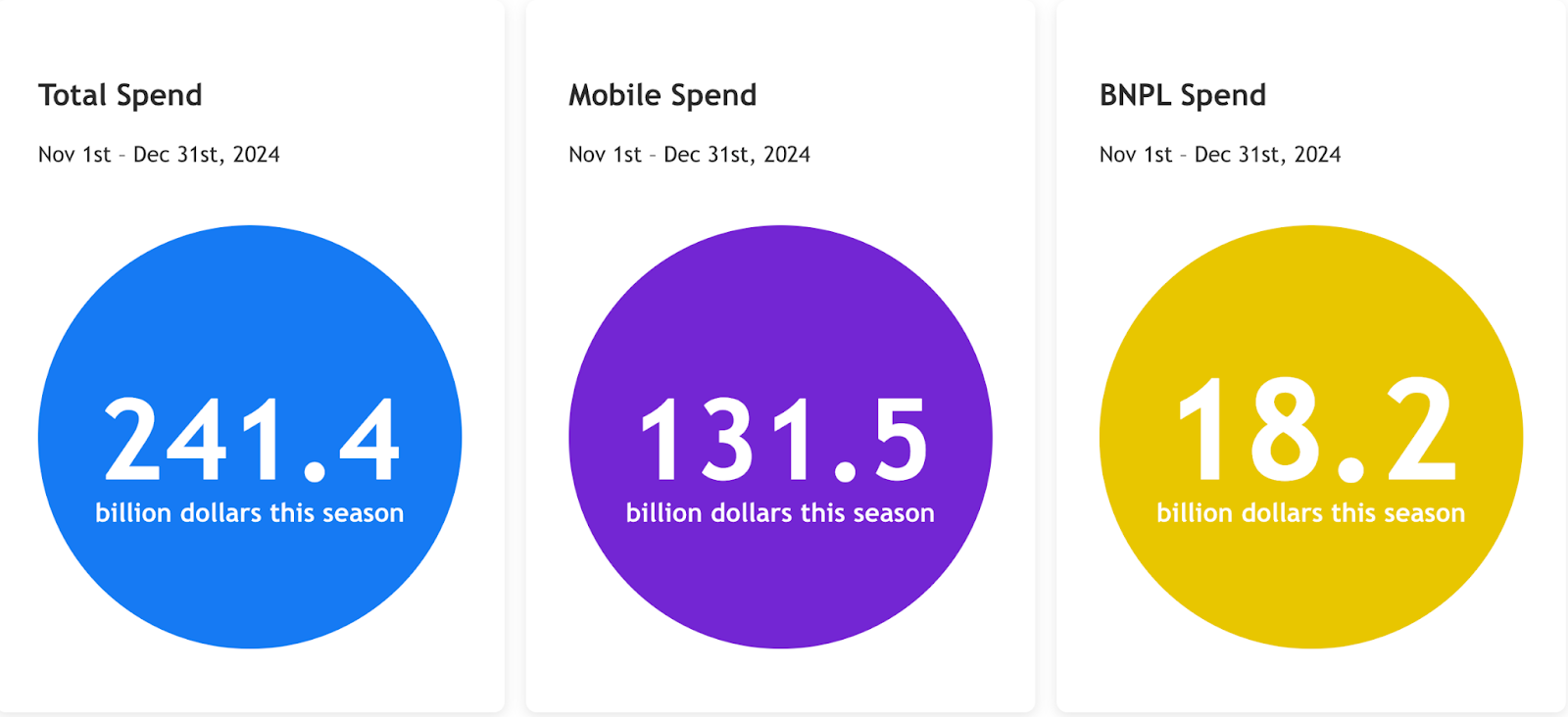

U.S. holiday online sales hit a record $241.4B in 2024, +8.7% YoY, and 54.5% of those purchases happened on smartphones, with BNPL up nearly 10%.

Your customers didn’t “return to normal”; they doubled down on convenient. That means your systems need to be convenient, too—eCommerce integration automation is not optional anymore.

Global context isn’t exactly bearish either. Salesforce clocked $1.2T in online sales globally across the 2024 holiday season in its observed dataset, while noting a returns surge that eats profit if you’re not operationally tight.

Translation: growth is still there—but you need clean pipes and reliable automations to keep more of it.

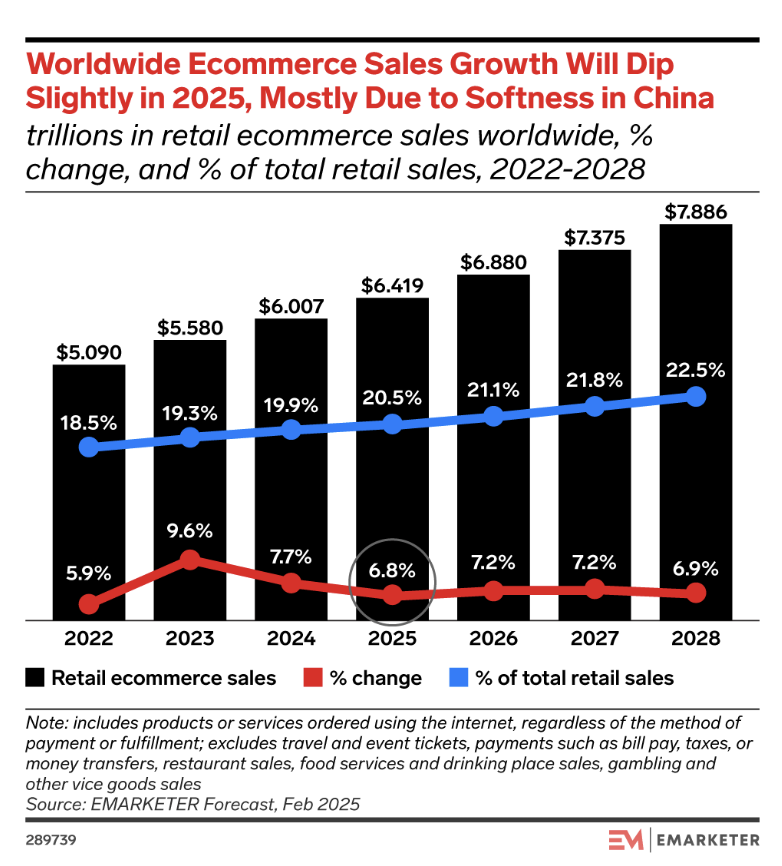

Forecasts? Insider Intelligence/eMarketer expects a brief growth dip in 2025 (China softness, trade friction) but an improvement by 2026. In other words: plan for steady, not sugar-high.

And if you wanted one last macro reason to fix your plumbing: generative AI’s value is real (up to $2.6–$4.4T annually), but it only pays off when your data isn’t a junk drawer. So yes, integrations come before AI magic.

Let’s get specific. Here are seven pragmatic growth levers for 2026 and beyond — written for teams without a 20-person dev squad and with eCommerce integration automation built into the steps.

Before we dig in, check out our full guide on how to use technology to grow your eCommerce business. It’s 100% free to read.

If 2020 was about “getting online,” 2026 is about making your data behave across storefront ↔ ERP ↔ CRM ↔ Marketing Automation—and doing it with as little heroics as possible.

This is where iPaaS comes in.

[We use the term “iPaaS” a lot and we’re well aware it’s not that popular among people who are not in this industry. Curious to see what it means? Learn what iPaaS is and why it matters.]

Why this grows revenue:

Fewer sync delays = fewer stockouts, fewer refunds, and faster lifecycle triggers (abandoned cart, thank-you series, replenishment) that convert. Your customer experience gets clearer and your team stops babysitting exports.

What “good” looks like (and how to get there in weeks, not quarters):

Where SyncApps helps: You get prebuilt connectors and playbooks for Salesforce (including NPSP), NetSuite, Mailchimp/Constant Contact, and more, with field-level preference mapping, real-time where it matters, and predictable pricing so December doesn’t break the budget. (Because “credit roulette” is not a holiday tradition worth keeping.)

Remember the cookie apocalypse? You know—the one that kept moving?

As of 2025, Google pivoted: third-party cookies aren’t going out with a bang, more like a “we’ll give users a choice” whimper. That doesn’t make consent optional; it just removes your excuse to ignore first-party and zero-party data.

You still need clean, consent-aware pipelines flowing across CRM, ERP, marketing automation, and commerce.

Why this grows revenue:

Deliverability, ad efficiency, and retention all depend on trust + relevance. If your opt-outs don’t propagate instantly or your MA ignores CRM preferences, you’re lighting money (and reputation) on fire.

What to do now:

Where SyncApps helps: Its bidirectional consent mapping between Salesforce/NetSuite ↔ Mailchimp/Constant Contact means your one truth actually lives in both places. Less time hand-stitching data, more time running campaigns that convert.

Try real bi-directional flows for $0.

54.5% of U.S. online purchases happened on mobile in the 2024 holiday season, peaking at 65% on Christmas Day, and BNPL spend rose 9.6%.

That’s not “a test”—it’s the dominant behavior. If your checkout, identity, and post-purchase flows aren’t mobile-first, you’re making money harder to spend.

Why this grows revenue:

A one-click-ish mobile checkout and fast post-purchase comms reduce abandonment, increase repeat purchase, and tame returns.

How to ship it in under a quarter:

Video was “big” in 2020. In 2026, it’s table stakes.

The difference now: you can connect view-through behavior to lifecycle automation. Short-form video, creator collabs, and live shopping (yes, the thing everyone argued about) now directly transact—hello, TikTok Shop—and feed segments in your stack.

TikTok Shop reportedly did ~$100M U.S. sales on Black Friday 2024 and hosted 30,000+ live streams, which is both a signal and a warning: if you’re not ready to attribute and service those orders, you’ll turn viral moments into viral customer service threads.

Why this grows revenue:

Short videos sell, but tighter eCommerce integration automation is what turns them into lifetime value instead of one-off dopamine spikes.

How to operationalize without a content factory:

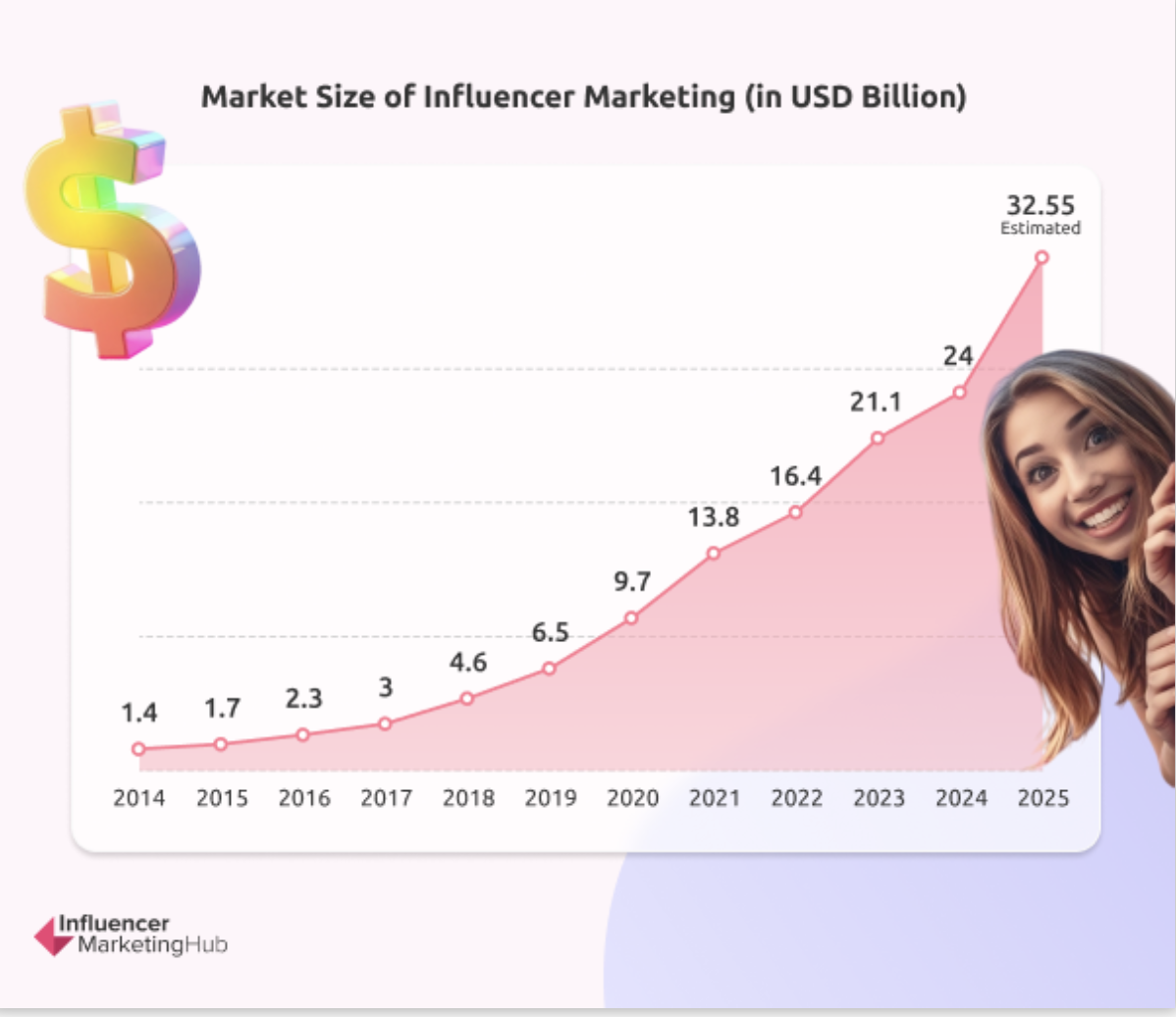

Partnerships and influencer marketing used to be “brand awareness.” Now, they’re performance channels with receipts.

The influencer economy kept growing into 2025, and social commerce monetization matured.

The job isn’t to “do influencer marketing”; it’s to treat creators as a measurable acquisition channel—attribution, SKU specificity, A/B on code sizes, and full funnel lift.

Why this grows revenue:

Creators bring net-new demand and trust you can’t manufacture. They also pressure-test your operations. If codes don’t redeem, orders don’t appear in CRM, or returns eat the promo, you’ll burn cash and relationships.

How to make it count:

No, affiliate isn’t “old.” It’s controlled, ROI-heavy distribution—and it’s growing. eMarketer projects U.S. affiliate marketing ad spend to top $10B in 2024 and exceed $15B by 2028.

Why this grows revenue:

Affiliates extend your reach with pay-for-outcome economics (CPS/CPL), diversifying beyond the auction ecosystems eating your margin. In tougher macro years, the capital efficiency matters.

How to do it without chaos:

Proof points to bring to finance: Track incrementality (new vs. returning customers), contribution margin after commissions, and LTV by affiliate category.

The only thing growing as fast as online orders? Returns. Salesforce estimates $122B in global purchases were returned during the 2024 holiday alone, +28% YoY. If your returns logic lives in email templates and sticky notes, that’s margin leaking.

Why this grows revenue:

Great post-purchase and returns flows reduce churn, trim costs, and create second chances (exchange → replenishment → loyalty). The kicker: you need event-driven automations and ERP-aware logic so your messages aren’t delusional.

Do this:

Where SyncApps helps: You can pipe order/return events from NetSuite ↔ CRM/MA, keep suppression/consent aligned, and log the whole show—so that when the board asks “what changed?”, you have data, not theories.

Does all the above sound great but slightly overwhelming? We’ve got you covered! Here’s your DOABLE 90-day roadmap, even if you don’t have a team of 100 people

Days 1–30 — Map and Make Choices

Days 31–60 — Template, Don’t Invent

Days 61–90 — Observe & Optimize Like a CFO

The market is still growing. The shoppers are still on mobile. Creators still move product. AI will keep promising the moon.

But boring on purpose—clean integrations, event-driven where it matters, consent that syncs, templates over hero projects—is what protects margin and sanity.

If that sounds unglamorous, good. Glamour doesn’t process refunds or prevent stockouts. Clean eCommerce integration automation does.

And when you want the plumbing to just…work, SyncApps is built to be the adult in the room: Salesforce/NetSuite/MA/eCommerce connectors with prebuilt workflows, consent hygiene, logs you can read, and pricing you can forecast.

Spend your creativity on offers, content, and partnerships—not on rebuilding the same connector for the seventh time.