Need to Close Your Books Faster with NetSuite? Here’s How to Do it

The task of closing books towards the end of the year can be easy to some but it can be an uphill battle to others. OK, let’s be honest for a moment. It’s definitely hard for almost everyone.

Whew, that feels so much better!

What makes the closing of books a difficult task is the lack of an efficient system that helps to streamlines the process and offers that much-needed accuracy.

Most companies recognize the need for efficiency in all their efforts. Efficiency translates to low staff turnover, low running costs, minimal chances of error and informed decision-making.

NetSuite offers efficiency in closing books. This accounting software offers tons of solutions that help financers in the process of designing, transforming and streamlining their operations.

NetSuite is seamless in its operations. For instance, the software offers real-time access to financial data. Real-time data is beneficial as it helps you detect errors or frauds faster.

Still, the successful closing of books calls for more than just integrating NetSuite. You need to look at:

Let’s take a look at all these things and see how we can make book closing much easier.

What Is NetSuite Used for?

First, here’s a brief background of the company. NetSuite is the world’s leading cloud computing business management software. The company was established in 1998 but was later, in 2016, acquired by Oracle for a colossal amount of money. But that’s a story for another day.

So, what’s the fuss all about NetSuite?

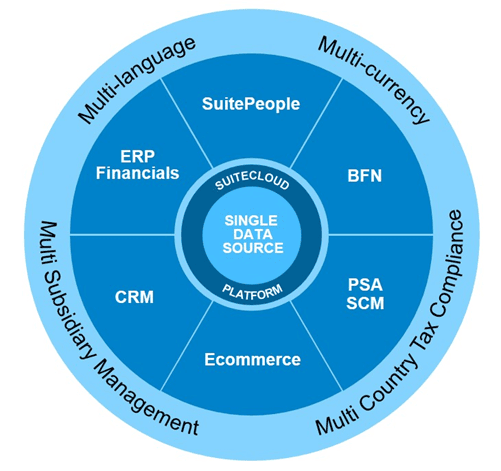

Well, NetSuite helps companies handle their core business processes by offering a single fully integrated software solution. NetSuite offers cloud-based financials, enterprise resource planning (ERP) and omnichannel commerce software.

Presently, NetSuite runs the operations of over 19,000 customers in over 200 countries. Most companies in the modern world are bombarded as to which ERP solution is best for their business.

However, industry experience reveals that NetSuite, which is basically an integrated business software system, has the lowest risk and the highest efficiency. NetSuite is simple, integrated, and intelligent.

Image Source: RMS

As a cloud solution, NetSuite holds all the firm’s data in one single database. The data is classified and maintained using several systems put in place to ensure data integrity.

NetSuite also helps with day-to-day operations. You can tackle activities such as order management, cash collection, invoicing, expense handling and order fulfillment with ease. This automation is beneficial as it turns your business into an agile workplace.

Why Do Companies Need to Close Their Books? (Or: It May Seem Like a Hassle But You Really Need to Do it)

To close books refers to the finalization of a company’s financial transactions. The books are generated for the purpose of:

The key purpose of closing books is to analyze the revenue, expenses, and dividend accounts of a business. NetSuite is an ERP solution that revolutionizes financial management. This tool consists of a flexible, multidimensional reporting system that allows you to segment, capture and store transactions.

With NetSuite, you can diagnose financial issues in real-time and drill down transaction details as soon as possible. This tool helps accounting teams to scale up their performance.

Why Closing Books at the End of the Year Is a Challenging Part of the Accounting Cycle

Closing an accounting period is a process that most accountants would be happy to procrastinate. (Seriously, simply admitting this will make you feel a bit better. Try it!)

Accountants are faced with numerous sensitive tasks that require minimal human error and the highest level of accuracy. What makes the closing of books so difficult is the length of time required to complete the task.

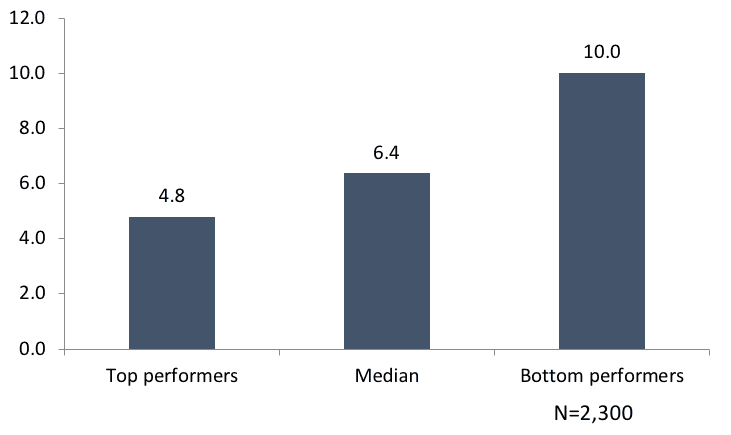

Image Source: CFO

A study conducted by the APQC revealed that it takes accountants a median amount of 6.4 days to complete a month-end close. Instead of using the 6.4 days to perform an analysis of the firm’s performance, accountants are left slaving away at balancing journal entries.

The lack of automation makes the closing of books labor-intensive. Consequently, such time-consuming tasks increase the risk of human error as they negatively affect the performance of the employees.

The 2017 Automation in the Workplace Report revealed that 69 percent of workers agree that automation reduces the time wasted during the workday. Fifty-nine percent of those surveyed admitted that if the office was automated, then they could save at least 6 hours a week since the repetitive tasks of the job would be automated.

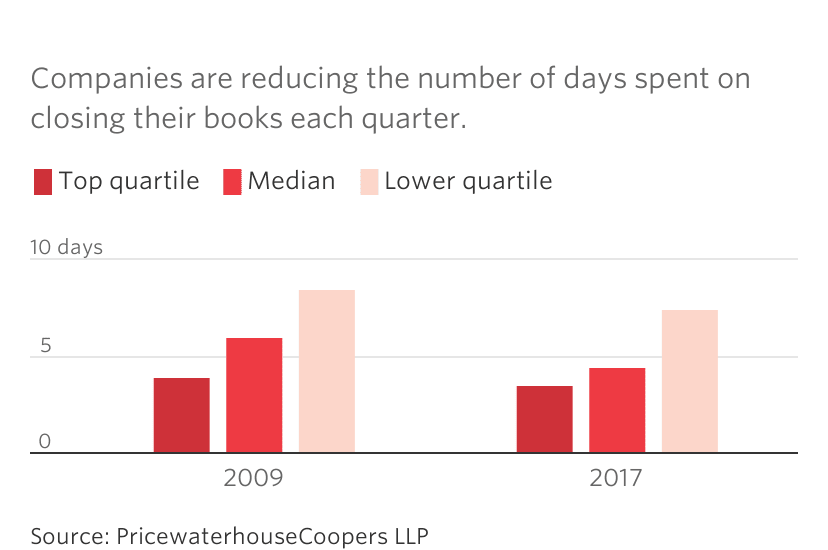

Image Source: The Wall Street Journal

According to The Wall Street Journal, technology has helped more and more companies close their books faster. This has helped in faster decision-making as well as made these companies more nimble.

The closing of books requires accountants to access a variety of data. This data may be vast and large depending on the company. Data acquisition is also challenging as the accountants have to access the data from different departments and source locations that may be scattered across the firm.

With automated solutions, tasks such as adjusting journal entries, transferring the journal entries to the general ledger and crafting the final trial balance have become much easier.

NetSuite offers an accountant complete control and visibility of the entire accounting process. This software helps manage every process in the accounting cycle, like revenue recognition, bank reconciliation and many more.

Procedures for Closing Books

Accountants approach the closing of books using two approaches. There is a hard approach and there is a soft approach.

Regardless of the duration of the process, the books of the previous month are left open so that the appropriate entries can be made up to the end of that month. This approach is beneficial as it ensures that the company actually produces accurate reports based on GAAP accounting principles.

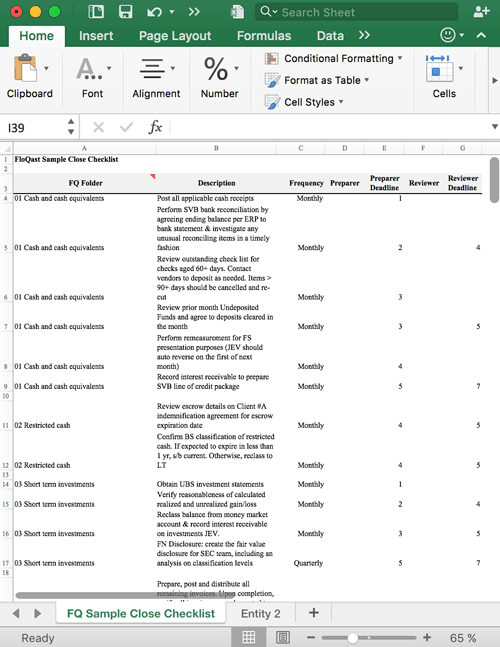

Book Closing Checklist (and Why it’s Super Important)

The monthly book closing is an integral process of accounting. This process needs to be performed quickly and accurately without neglecting any details.

If you intend to perform this task without automation, then you will require a checklist with the elements listed below:

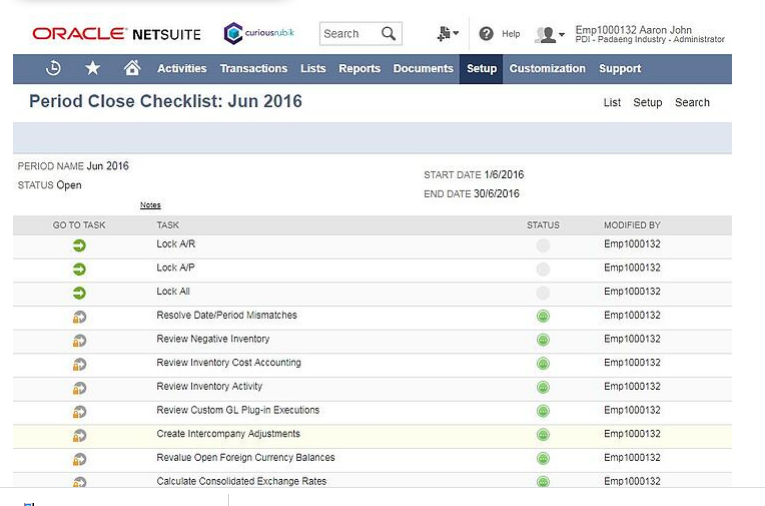

Image Source: NetSuite Checklist

Below are some tips on how NetSuite helps you close your books faster with minimal risk error.

1. NetSuite Boosts Your Company’s Data Integrity

Corrupted, altered, or deleted data can have detrimental, far-reaching and sometimes irreversible consequences in your company. A Forbes report revealed that 84 percent of chief executive officers are concerned about the data they use to make decisions.

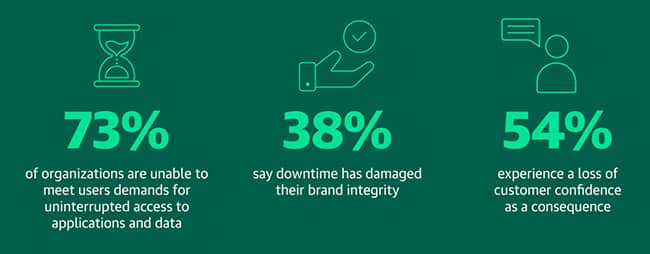

This is because of the concern over data integrity. The report points out that poor data costs companies approximately $9.7 million annually. According to HelpNetSecurity, poor data management can cost organizations $20 million each year.

Image Source: HelpNetSecurity

NetSuite helps companies improve their data integrity system. It achieves this through data classification and maintaining data quality.

2. Data Classification

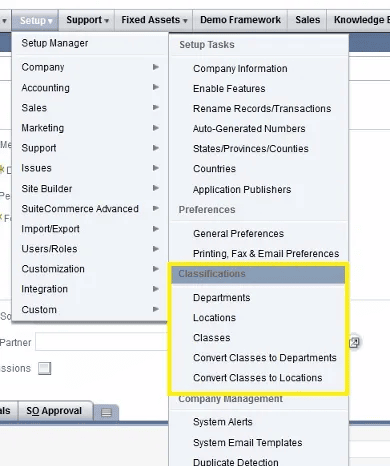

Accurate classification of data can significantly improve your financial planning and reporting. Fortunately, the NetSuite app comes with a variety of features that assist with data classification.

The standard NetSuite, for example, consists of the department, classes and location features that help you to classify and track data. You can use the department segment to keep data pertaining to transactions and employees in each department.

The locations feature helps you to filter and track data. This will require you to create a record for each location you intend to track. After that, you can link employees and transactions to a particular location.

Image Source: Oracle Netsuite

NetSuite is highly customizable. Therefore, you can classify data depending on your unique needs.

However, to ensure that data is classified correctly, you need to do the following:

Image Source: Classifying Data In NetSuite

With NetSuite, you stand a 99.5 percent chance of maintaining data quality. We like these odds!

There are several ways to go about this. First, you have to set up alerts that monitor your data continually.

You should also enable the Saved Searches option. This option will ensure that you receive a notification in case of any inventory adjustment, keying in or wrong data or alteration of data by a person.

The NetSuite search feature helps you monitor outstanding entries. To do this, you use the search feature to track data. For instance, you can search for orders that have not been shipped within two days. If you want to track unbilled search orders that have lasted for more than 30 days, you can use the search option to do it.

NetSuite also offers accuracy and consistency. When you synchronize the software, you are able to access data and reports wherever they are located.

NetSuite has a “center tab” that helps you retrieve all the reports that the finance department is analyzing. Moreover, you can create searches for posted transactions that you would like to monitor.

With NetSuite, you do not run the risk of duplicate data. To prevent duplicates:

Once NetSuite detects an error, you will be notified immediately, as shown in the figure below:

2. Role Efficiency

A major step in the closing of books is the auditing process. When preparing for an audit, you need to ensure that the roles and duties are clearly defined.

There are several ways that NetSuite helps you achieve this. First, you can generate a role-based report. The report highlights the role of each user plus the permissions delineated for each role.

Alternatively, you can carry out a search. The search can help you locate which user has an administrator role or other “special user” role for each member. This will help you assess the access level for each user.

It is a must to continuously monitor role definition and data integrity in order to close the books faster. NetSuite offers continuous monitoring of data and role definition using its native capabilities.

With NetSuite, you can lock transactions at a certain point so that other people do not alter the data. Also, you can create specific roles for key departmental leads to enable them to approve or override transactions in their day-to-day activities.

NetSuite offers features that help you leverage your workflow. It also comes with tools that boost your day-to-day processes such as the automatic updating of changes in the transaction process. Indeed, the beauty of NetSuite lies in its effortless data manipulation.

For instance, employees no longer need to spend time translating data from disparate platforms to ensure data integrity. Also, the synchronization of the app in the company includes a dashboard that provides daily summaries concerned with each of the tracked data. This makes it easy for you to close your books.

Large companies typically have multiple accounting systems. This is due to their various operations located in different geographical locations as well as the possibility of having rogue employees who might want to defraud the organization. Also, large firms have to deal with mergers and acquisitions.

Consequently, the different geographies bring the issue of different regulation procedures that call for different formats of reporting. NetSuite helps companies achieve consistency through synchronization. The app also helps you build a consistent format of results that is accurate and in real-time.

3. Streamlining Approvals and Audits

You need internal approval to close journal entries. However, if you do not have efficient software such as NetSuite you run the risk of laboring for hours on end working on your journal entries.

To reduce the time spent on the journal entries, you can activate NetSuite’s saved searches to streamline approvals. What you need to do is:

The NetSuite “persist search” option can also help you quickly close your books. This feature helps you develop an extensive trial balance export report for your auditors.

4. Solution Integration

Keeping data accurate, consistent and complete when closing books is not enough. You will need to integrate NetSuite with other solutions. This will help you achieve integral aspects of closing the books such as:

The closing process becomes daunting as the volume of transactions goes up. As a result, you have to leverage integrations from NetSuite to successfully boost your closing process.

Want to integrate NetSuite with other mission-critical solutions in your company? We can help you integrate it with a variety of CRMs, eCommerce solutions, Marketing Automation platforms, Support Software and more. Get started for free!

5. Generating Financial Statements

The automation facilitated by NetSuite helps you develop balance sheets and income statements easily. NetSuite comes with a financial report builder.

Thanks to the data classification solution, you can generate accurate statements and reports from consolidated data. Not only can you create financial statements but you can also customize them, for instance, by adding additional fields in the financial statement.

NetSuite’s automation of financial statements makes the closing of books easier. You can set up the app with localized tax calculations. Furthermore, you can define the tables that you create with unique lines that highlight information that relates to other fields in the business.

Since NetSuite offers real-time data acquisition, you can update your financial statements easily on any web browser or mobile device.

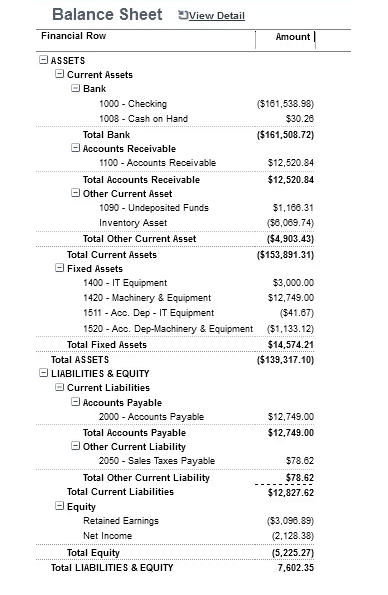

A NetSuite balance sheet contains three categories. Assets, liabilities, and equity. To access the Balance sheet, you go to NetSuite, reports, financial, and balance sheet. You can manipulate the data in the balance sheet by controlling the filters. You can either customize the filters or use the ones provided in the app, e.g class, item, department.

When you select a filter, you will see the amount assigned to that particular class, e.g. retail store sales within the past six months. This is beneficial when you want to view the complete financial snapshot for a department or a particular class.

6. Generate a Final Trial Balance

The final trial balance report mostly contains the balance sheet reports. You develop this report after zeroing out your revenue and expense accounts. Also, you have to ensure that the debit and credit accounts match.

Without accounting software, this task may be time-consuming. Also, there is the risk of human error and the alteration of data. However, the alert feature of NetSuite helps maintain the integrity of the data by altering you in the event of any changes in the numbers. You get an alert on who did what to the data immediately.

You produce the final trial balance using saved searches. Here’s how to go about it.

First:

The date ranges will help you retrieve the saved searches. There is no traditional ledger in NetSuite. Instead, you have summarized transaction details that you locate and transfer to the final reports. This is why NetSuite is a real-time system that does not require you to update any general ledger.

Image Source: NetSuite Balance Sheet

NetSuite offers a quick way to close your books within the touch of a button. You begin by enabling the “quick accounting period close,” in the set-up. In the setup, click accounting, accounting preferences, general, and turn on “allow quick close of accounting periods.”

Once you activate this feature, you will get the option “manage accounting periods.” Next, you will get the “close multiple periods option.” When you follow these steps, the app automatically begins the process of closing the books.

All the trips explored here not only work with the end of the year closing process but also with monthly and quarter-end closes.

Applying these tips will help you achieve timely closes at the end of every financial period. NetSuite transforms your operations by successfully streamlining and automating the most important processes. Closing of books has never been easier.

How to Make Closing Books Less Daunting

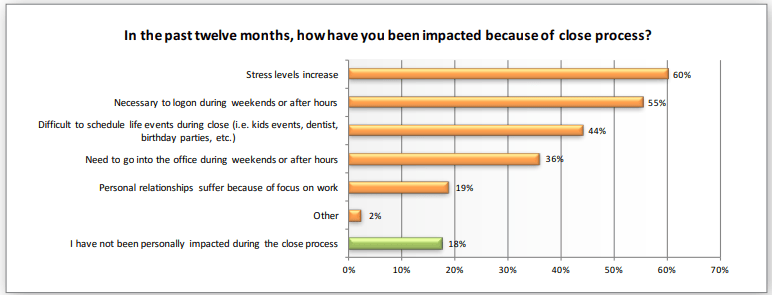

Today, 85 percent of accountants have a negative experience when it comes to closing of books. But why is this so?

For many accountants, these issues translate to long working hours plus frequent restatements. One-third of accountants admit that the frustration associated with the closing of books leads to job stress that negatively affects their personal lives.

Image Source: Stress levels resulting from the Closing of Books

Pro Tips to Close Your Books Confidently

The closing of books calls for a systematic way of doing things. How fast you complete this process depends on whether you leverage NetSuite or not.

With NetSuite, you can:

And yes, NetSuite has its own shortcomings (doesn’t everything, though?). This is why we decided to help accountants and make their lives easier. Integrate NetSuite with your other systems and say goodbye to the book closing stress.

Image Source: Floqast

If you use NetSuite along with a collaborative month checklist, then you are sure to perform the task accurately with a minimal amount of stress. NetSuite has a free month checklist that you can use. Purpose to stick to the tips shared here so that the closing books process can be easier for you to manage.