The State of the Martech Industry and How it Affects You

There are fewer new customers. The pandemic brought about a peak in martech sales. Anyone who didn’t have a CRM or a marketing automation platform scrambled and got one within days.

We know it just as well as other martech vendors. SyncApps didn’t just survive during the pandemic, we thrived.

We wrote about why that happened (see the link above). While our strategy had a lot to do with it, the naked truth is that the market conditions were favorable to martech sellers: the last big wave of digital transformation was taking place.

From there on, industry growth has been modest and it looks like this trend won’t change any time soon.

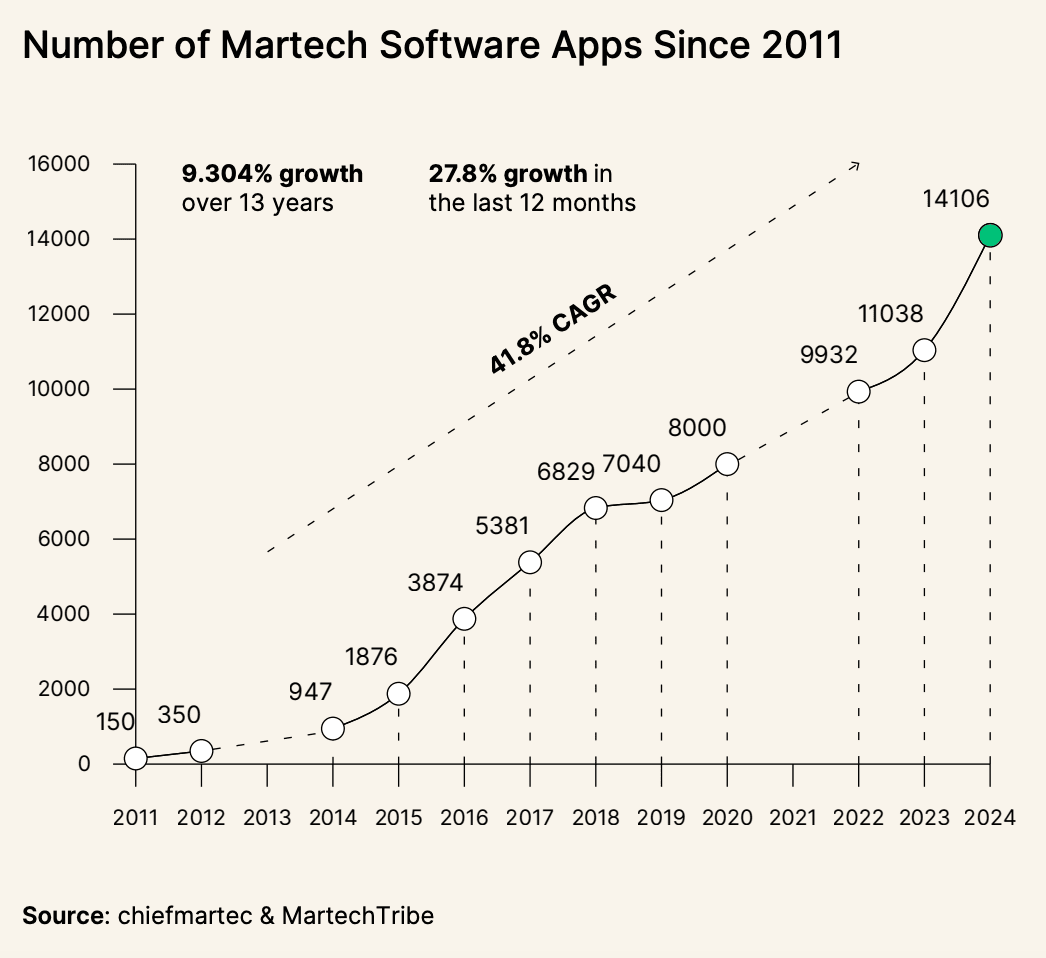

The 2024 Martech Interactive Supergraphic has 14,106 products — 27.8% more than the 11,038 on last year’s landscape. Since the first issue was released in 2011, the number of martech solutions has grown by a whopping 9,304%! That is a CAGR of 41.8%.

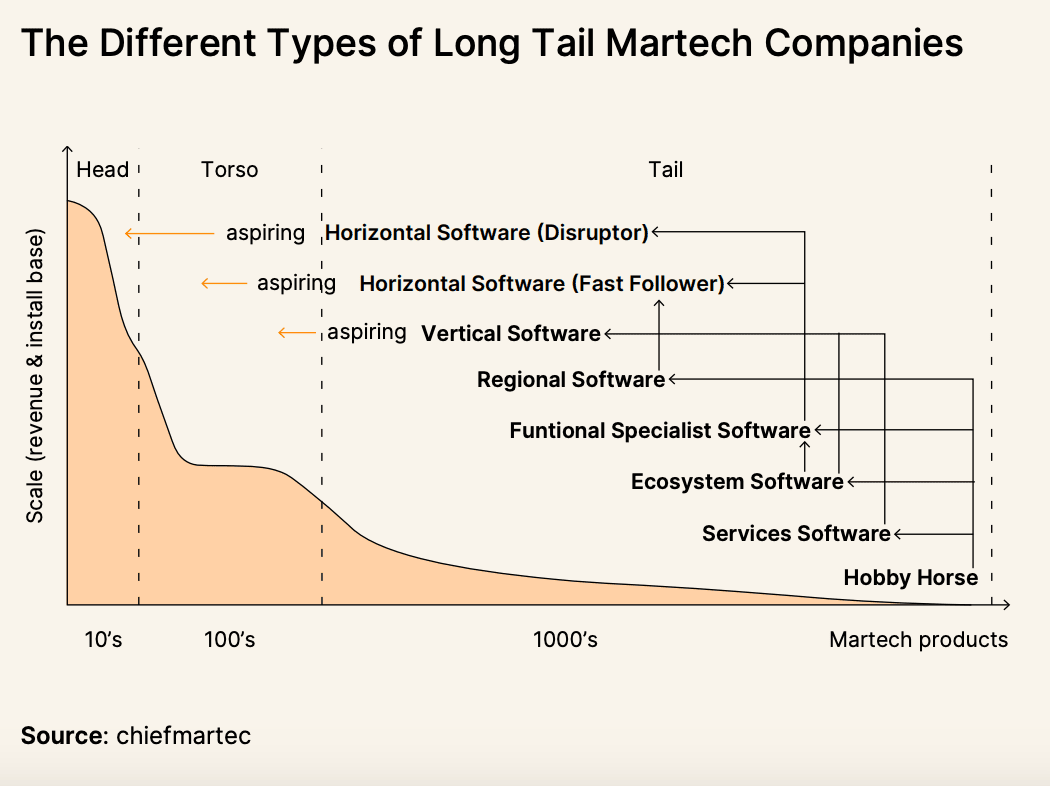

The major players, public companies that make billions in revenue, like Oracle, Google, Salesforce, and others, make up but a small fraction of the total number of players, yet a huge fraction of the total revenue of the industry.

The big players in the industry consolidate their position by acquiring smaller players, whereas the smaller players usually come and go. This happens in any industry, not just martech.

For big players, growth happens mostly through the acquisition of other companies. Medium-sized and small players, on the other hand, need to focus on client acquisition.

Even though the last big wave of digital transformation happened during the pandemic, there are still new clients out there — new companies in all industries and, more importantly, new marketing agencies that can generate more than one client for a martech solution.

If you look at iPaaS, the growth is even more staggering: back in 2009-2011 when we got started we had 5 direct competitors. Today, there are 256 companies in iPaaS alone.

This is a 50x growth rate. In my view, this spells saturation. Existing companies can still grow in this space but newcomers will have a harder time than ever.

Think my prediction is a bit bleak?

Consider this: the CRM market is expected to grow by 4% in 2025. iPaaS is highly dependent upon this market — if a company does not use a CRM or an ERP, they have no use for integration either.

Moreover, the clients are consolidating their SaaS stacks.

This is a fancy way of saying that companies use fewer SaaS solutions. This is a direct consequence of SaaS companies using an obsolete pricing model that never favors the user.

Of course, that’s not the only reason. SaaS subscriptions add up pretty quickly, and everyone is trying to optimize costs.

Remember when OpenAI’s Sam Altman said that AI could empower the first one-person one-billion dollar company? It’s one of the most out-there predictions in this space but, hey, we all know that bullish statements attract investors.

Altman’s prediction is far from becoming reality but it’s not entirely outside the realm of possibility. Granted, it depends on how you define a one-person business — do freelancers and contractors count?

But I digress.

Love it or hate, AI has had an impact on the martech industry in general. Despite bullish statements, most martech suffered.

Sure, we all integrated AI into our product stack to some degree, but this hasn’t sheltered most martech solutions from a radical drop in clients.

Just look at Salesforce’s CEO, Marc Benioff, scrambling to keep a happy face while admitting that AI has been bad for business.

All of the signs above point to a single conclusion: we can finally say that martech is a mature industry.

With a taller entry barrier and less impressive year-over-year growth, the companies in this space will have to work at consolidating their market share. That’s what happens when there is limited room for growth.

Add a bit of economic uncertainty, and you’ll have the perfect storm.

Does this mean that there will be no brand-new companies that get to unicorn (over $1 billion valuation) status in a couple of years? No, absolutely not.

It’s still possible, yet less probable.

For you, the martech user, this means good news. Here’s what I forecast for the upcoming years:

As I said, this is all good news for the end users.

Perhaps this sounds weird coming from someone who owns a martech company, but I welcome this phase. I don’t know when/if the next digital transformation wave would happen but, in the meantime, it doesn’t hurt to focus on delivering solutions that are actually good.

You might have inferred this already, but I don’t dread a lower growth pace. SyncApps has been comfortably profitable for two decades now, and we’re not eyeing an IPO.

I’ve spent enough time in this industry to know that external funding comes with many strings attached, and those strings typically hurt great products.

The reason why we’ve been in business for so long when most of the iPaaS solutions in the same category as SyncApps have been acquired or have gone belly up is simple: we had a single big stakeholder: our clients.

We didn’t have VC funds or shareholders breathing down our necks and pushing for growth no matter what. So we kept on building a solution users actually enjoy and get profit from.

So here’s what we’re going to do:

So yeah, as the French say, plus ça change, plus ça reste le même — the more things change, the more they stay the same.

As always, please know that our inboxes and our calendars are open to any suggestion, so don’t hesitate to contact us. SyncApps is a niche iPaaS player it is today precisely because we’ve built features that you suggested, not features we deemed cool.

Not on SyncApps yet? Hop on board, it’s free to try, so what have you got to lose?